Business Insurance in and around Philadelphia

Philadelphia! Look no further for small business insurance.

Cover all the bases for your small business

This Coverage Is Worth It.

It's a lot of responsibility to start and run a business, but you don't have to figure it out all alone. As someone who also runs a business, State Farm agent Dan O'Mara knows what it's like to put in the work that it takes and would love to help lift some of the burden. This is insurance you'll definitely want to investigate.

Philadelphia! Look no further for small business insurance.

Cover all the bases for your small business

Insurance Designed For Small Business

If you're looking for a business policy that can help cover extra expense, buildings you own, and more, State Farm may be able to help, just like they've done for other small businesses for almost 100 years.

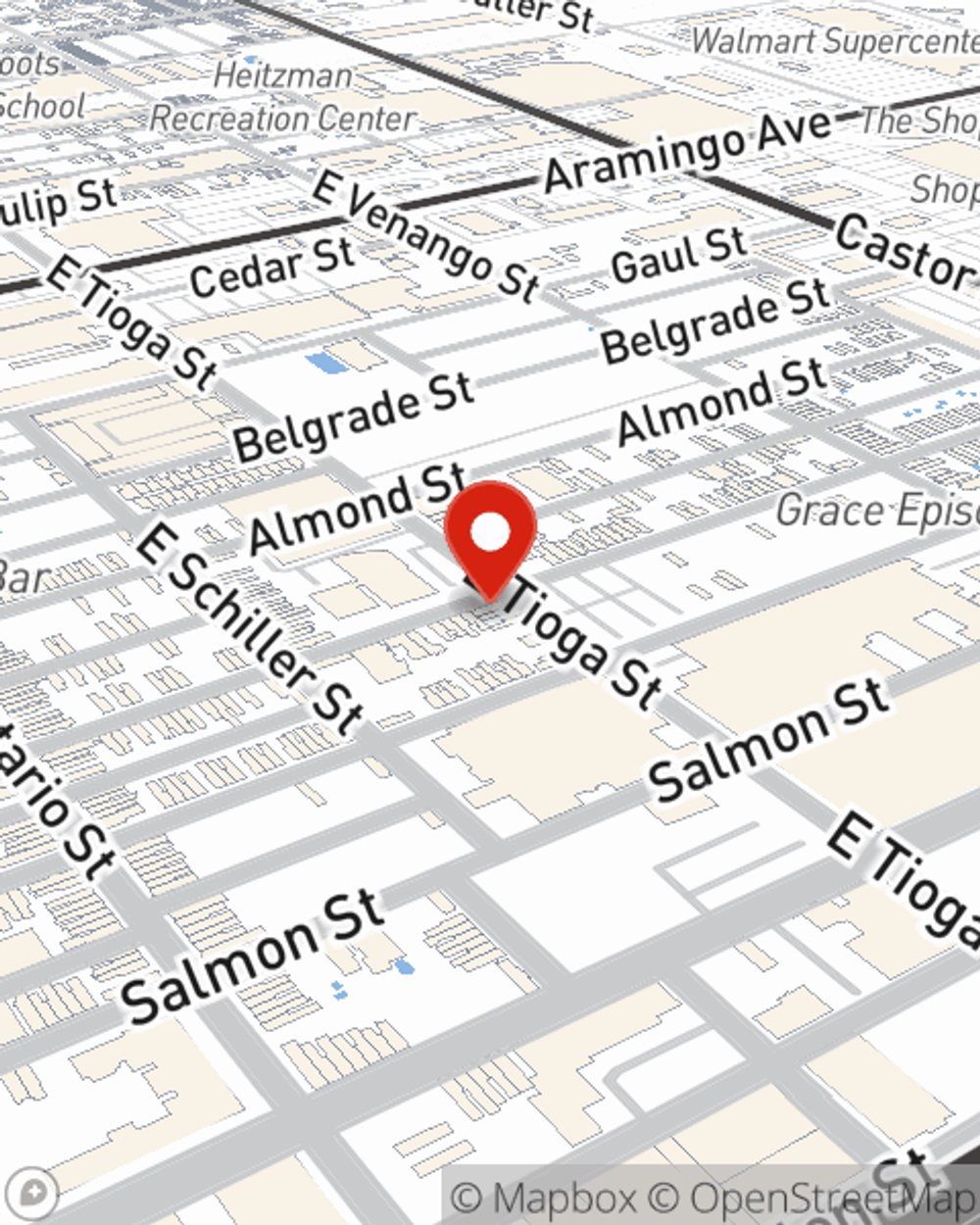

Visit State Farm agent Dan O'Mara today to experience how one of the leaders in small business insurance can safeguard your future here in Philadelphia, PA.

Simple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Dan O'Mara

State Farm® Insurance AgentSimple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.